#20 Duolingo: Gamification Of Learning

Duolingo

Duolingo is the leading global mobile learning platform, offering courses in 40 languages to approximately 40 million monthly active users. The app has organically become the world’s most popular way to learn languages and the top-grossing app in the Education category on both Google Play and the Apple App Store.

Market

The global market for consumer language learning is large, growing, and shifting online. According to HolonIQ, there are 1.8 billion people in the world learning a new language. Duolingo is capturing this market and actually expanding the language learning market. For example, according to a survey Duolingo conducted in 2021, almost 80% of Duolingo users in the US were not already learning a language when they began using Duolingo.

Business Model

Paid Subscribers: Duolingo offers a paid subscription service called Duolingo Plus. It offers learners features such as an ad-free experience and additional learning and gamification features that enhance their learning experience.

Testing: Duolingo produces revenue from generating revenue from the Duolingo English Test by charging test-takers a one-time fee of $49. University program acceptance is a driver of Duolingo English Test revenue. As of May 2021, over 3,000 higher education programs around the world accept the Duolingo English Test results as proof of English proficiency for international student admissions, including 17 of the top 20 undergraduate programs in the United States, according to US News and World Report.

In-app testing: In-app purchases consist of learners purchasing one-time benefits within the app, such as “streak freezes” and “timer boosts.”

Financial Analysis

Results(2019 & 2020):

Total revenues of $70.8M and $161.7M, representing YoY growth of 129%.

Subscription revenues of $54.8M and $117.5M, YoY growth of 114%.

Gross profit of $50.0M and $115.7M, YoY growth of 131%.

Net loss of $13.6M and $15.8M, YoY growth of 131%.

Adjusted EBITDA of $(8.0) million and $3.6 million, respectively;

Free cash flow of -$3.1M and $14.0M.

Income Statement Breakdown

Operating Performance

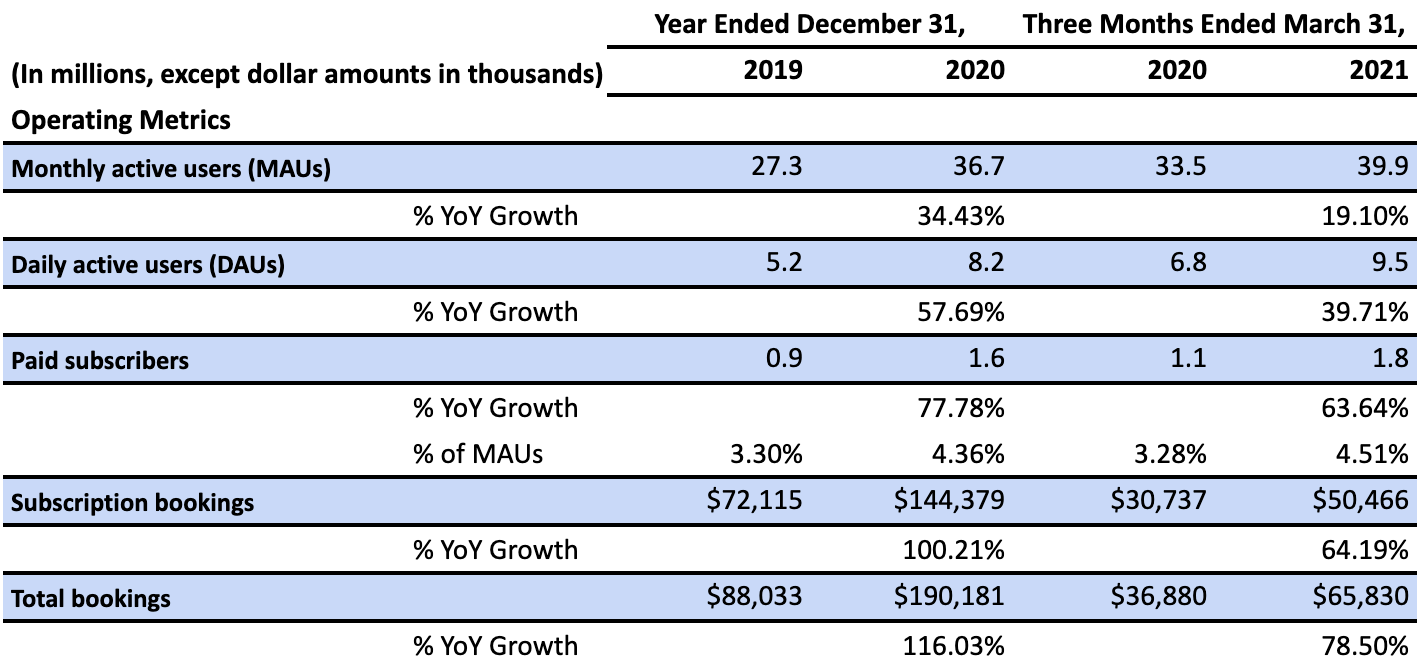

Duolingo has showcased strong operating growth(2020):

57% YoY growth in MAUs.

34% YoY growth in DAUs.

77% YoY growth in paid subscribers.

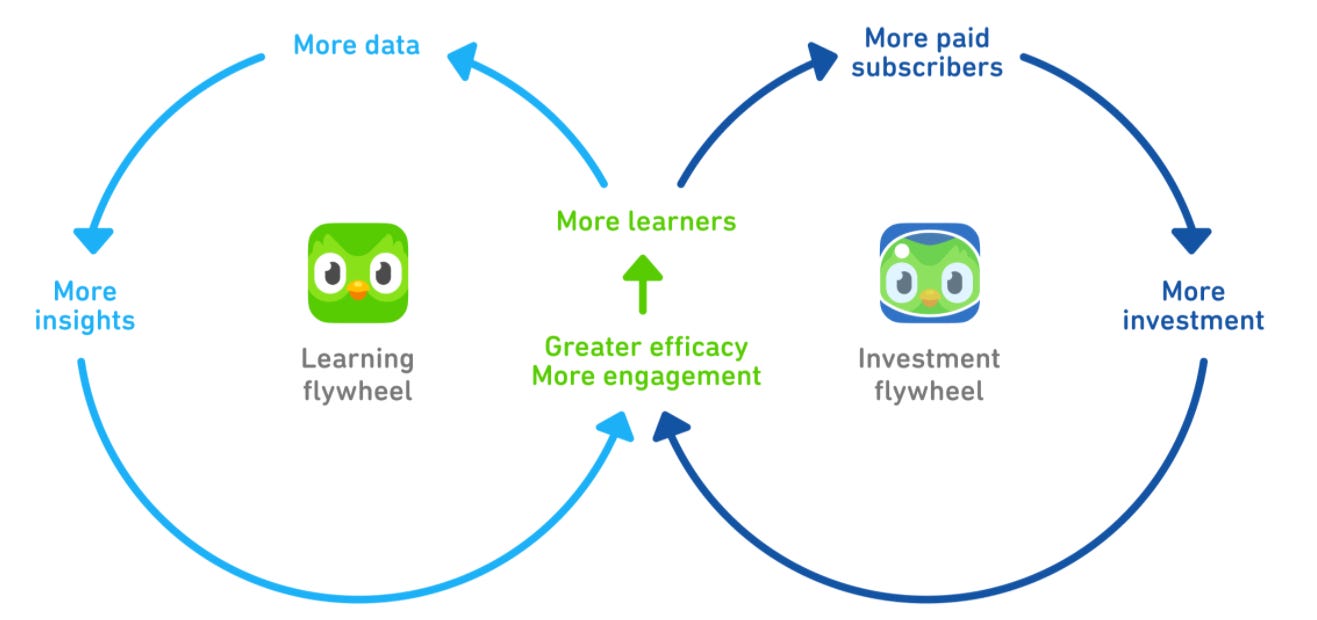

Product Led Growth

Research and development expenses were 45% and 33% of Duolingo’s total revenue in 2019 and 2020, and 34% and 41% of the total revenue in the three months ended March 31, 2020, and 2021.

Being a consumer-facing language learning application, Duolingo has truly created a niche and used product-led adoption to create growth. In terms of competition, there are many other players in the language learning space like Rosetta Stone, Babbel, and others but the Duolingo platform has the best experience due to the gamification of the product and bite-sized lessons(4 minutes each).

Pricing

Duolingo has three payment plans that are inexpensive with the intention of making the application accessible for all individuals. I definitely see how this aligns with the companies goals but also believe that having such a monetization strategy is an inefficient use of the traction.

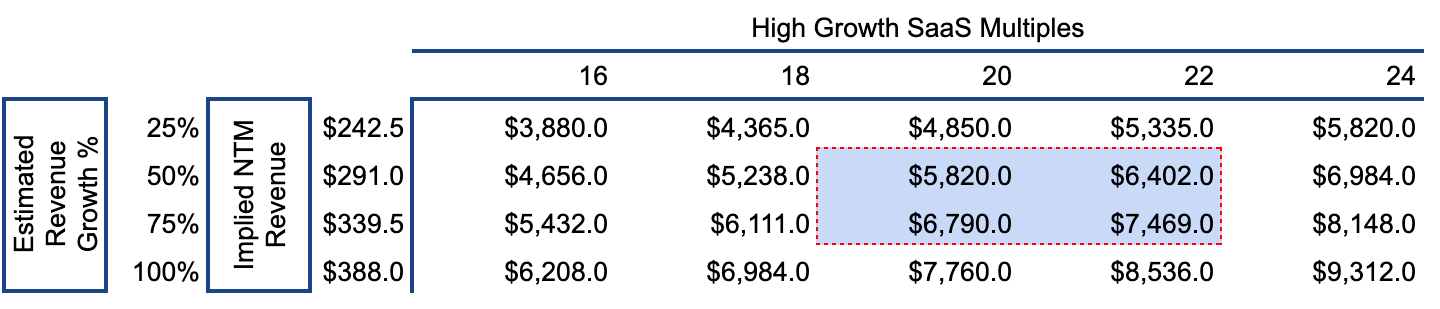

Valuation

Duolingo currently has a market capitalization of $6.1B, and the stock has appreciated over 17% since its IPO in July 2021.

Conclusions:

Massive market with strong positioning: Duolingo operates in a huge market and has positioned itself as a tool for lifelong learners. This is a big moat as it will lead to higher retention and activity as users are on the platform for the love of learning more than anything else.

Strong operating metrics: Duolingo has showcased very strong DAU & MAU growth. This is a direct result of their unique positioning and product offering.

Lack of monetization and weak pricing: Monetization has lagged since the inception of the company. The number of paid subscribers as a percentage of MAUs has showcased very slow growth(4% of total MAUs in 2020). This, coupled with three inexpensive pricing plans, showcases the potential it has for growth.

Activist investors: Duolingo seems to be an optimal target for activist investors because of its solid traction but lack of monetization. The team at Duolingo has to showcase better metrics on both the top and bottom line to prevent that from happening. Otherwise, I won’t be surprised to see one of the large activists come in and create short-term value by creating shifts in the product roadmap to focus on greater monetization.

Good growth with a path towards profitability: Duolingo has generated 128% YoY revenue growth with high gross margins(71%). The company is still loss-making with net loss margins of -9.7%, but this is primarily due to high R&D and S&M spend, which are 32% and 21% of total revenue. I’m bullish on the trend that software platforms like Duolingo can showcase profitability if needed by pulling back R&D and S&M expenses.

Richly valued: Duolingo is currently trading at $6.1B, which is 31x LTM revenue and 22x NTM revenue. I believe that the company’s valuation is high considering its multiples, but that’s the current market ecosystem. There is an argument to be made for lower multiples, but I’m still bullish on Duolingo, considering its profit potential.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.