#13 Compass: Pointing In The Right Direction

Summary:

Real Estate 2.0: The Real Estate Renaissance.

Strong operational growth.

Strong financial performance: Improving margins with strong topline growth.

Valuation: Undervalued due to current market conditions.

Compass: Pointing in the right direction

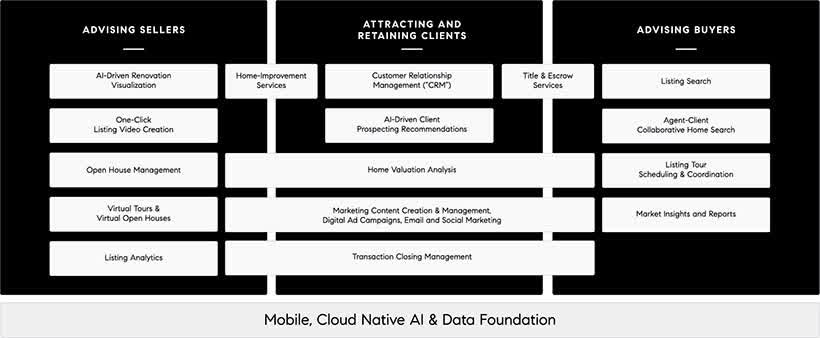

Compass provides an end-to-end platform that empowers residential real estate agents to deliver exceptional service to seller and buyer clients. The platform includes an integrated suite of cloud-based software for customer relationship management, marketing, client service, and other critical functionality, all custom-built for the real estate industry.

Product Offerings

Revenue components:

Commission revenue: Compass earns revenue from commissions they receive from clients when their agents represent them in a home transaction(Commission Revenue = Gross Transaction Value * Commission Rate). Commission rates for buy-side and sell-side transactions typically range between 2.5% and 3.0% of a home’s sale price. Compass generates a small portion of commission revenue from rentals, new development projects, and commercial real estate transactions.

Adjacent services revenue: Generate revenue from adjacent services related to a real estate transaction such as title and escrow, non-commission-related revenue streams, including fees related to transaction coordination services, and professional services related to new development business.

Real Estate Market(Size & Characteristics)

Residential real estate is one of the largest industries in the world. According to the National Association of Realtors, more than 5.6 million homes were sold in the U.S. in 2020, representing approximately $1.9 trillion in transaction value. The Association of Real Estate License Law Officials (ARELLO) estimates that there are about 2 million active real estate licensees in the United States. These numbers truly showcase the size of the opportunity and why Compass’ thesis targeting real estate agents makes a lot of sense.

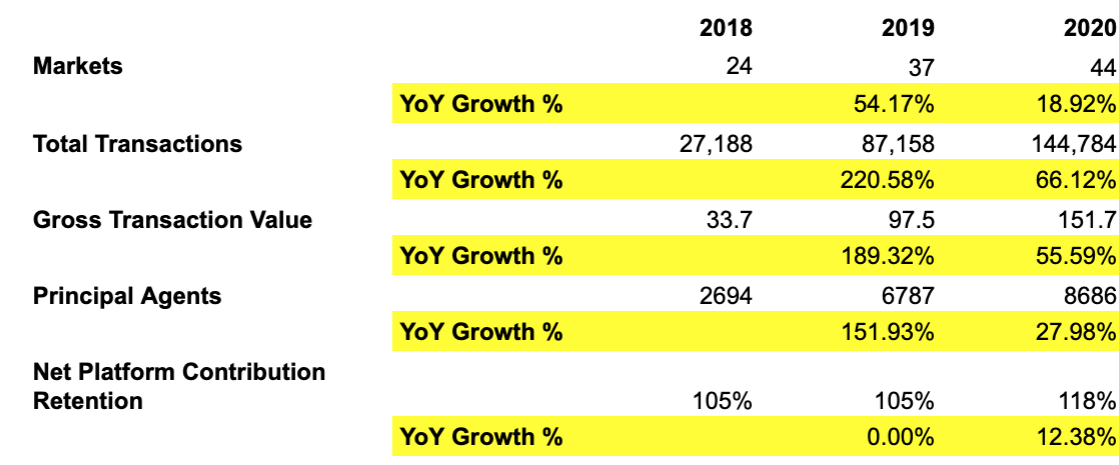

Key Operational Metrics:

In terms of its operational metrics, Compass has been doing phenomenal work to increase growth in all aspects. The total number of principal agents and transactions has increased by over 140% and 125% on average in the last 2 years. The growth in core metrics shows that Compass has built a solid growth engine that can be replicated to not just onboard more agents but also help them become successful. I believe that if Compass continues to expand into the right markets using the current capital raised, then it can grow out its current valuation to become a dominant player in the real estate space.

Key terms:

Total Transactions: Total Transactions are defined as the sum of all transactions closed on the Compass platform in which their agent represented the buyer or seller in the purchase or sale of a home.

Gross Transaction Value: Gross Transaction Value is the sum of all closing sale prices for homes transacted by agents on the Compass platform.

Net Platform Contribution Retention: We use Net Platform Contribution Retention to measure their ability to grow transactions and revenue per transaction within their existing agent base.

*Compass as a platform double counts transactions and their values if both the buyer and seller perform the transaction through their platform.

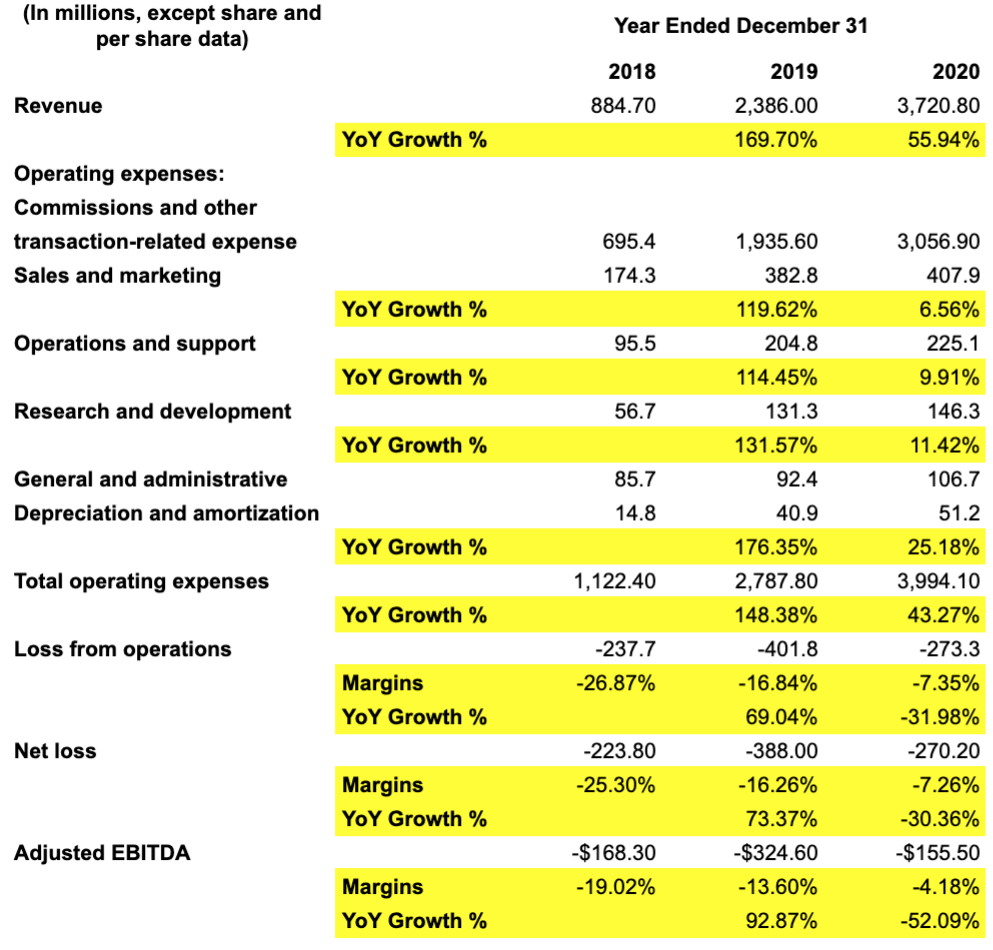

Financial Metrics

Summary:

Loss-making but improving margins: In 2019 and 2020, Net Losses were $388 M and $270 M, representing margins of -16.26% and 7.26%, respectively. Margins are becoming better despite the pandemic and slower growth in the overall market.

Incredible topline growth: Driven by closed transactions through the platform, Compass’ $3.75 B in revenue is humongous. Most notably, the company has been primarily focused on closing transactions and has not started upselling to its agents. This is a tremendous opportunity for them as agents deal in multiple.

Voting Rights: Reffkin owns about 6% of the overall company but about 46% of its voting rights. This is primarily because he owns all of the company’s Class C stock which has 20 times the voting power of Class A shares.

Rushed IPO: Cash is King: Compass is yet another example that emphasizes the first principles of running a business: Cash is King. Compass as a company is in an incredibly huge market, growing at a decently fast rate, providing real value, but the huge burn pushed the company into a corner where they had to go public in order to survive. Compass provides an end-to-end platform that empowers residential real estate agents to deliver exceptional service to seller and buyer clients. By leveraging technology, Compass has been able to reach millions to buyers and sellers and helped facilitate over $300 B in transactions. But when it comes to the incentive structure, the company works like a real estate broker who takes a percentage of the profits. This is a smart move as if the platform is able to truly provide value, then charging a small monthly subscription fee to help sell multi-million dollar properties makes no sense.

Valuation

Pre-IPO: The company raised $500 million of Series G venture funding from SoftBank Group, SoftBank Investment Advisers, and Dragoneer Investment Group on November 11, 2019, putting the company's pre-money valuation at $6 billion.

IPO: The company raised $450 million in its initial public offering on the New York Stock Exchange under the ticker symbol of COMP on April 1, 2021. A total of 25,000,000 Class A shares were sold at a price of $18 per share.

The company is currently trading at a market capitalization of $7 B, which equates to 1.8 times its revenue. Considering other characteristics of the company(massive market, strong growth with increasing margins), Compass looks like a good buy at its current price.

Competition

The real estate industry is a crowded market with multiple players due to its enormous size and highly lucrative metrics. But as described earlier, the space is massive, with space for everyone to have a piece of the pie.

Real Estate 2.0: The Real Estate Renaissance

Compass as a company represents the renaissance of the industry: Real Estate 2.0. The first set of players that started in the early 2000s, like Zillow and Redfin which were truly just listing platforms. Almost like early marketplaces, they solved the then urgent need of transparency and demand and supply consolidation. The new set of companies that have grown over the last decade is trying to revolutionize how this humongous industry functions at its core. Technology-enabled businesses like Compass and Opendoor utilize technology to reach bigger audiences and work to streamline more complex systematic processes.