#10 DocuSign: Sign me in

Product Love: Efficiency and effectiveness

Strong tailwinds due to push towards digital

Strong operational & financial growth

Richly priced stock despite long term losses

Founded in 2003, DocuSign is a category-defining e-signature platform that has helped individuals, SMBs, and large corporations automate their agreement process.

DocuSign offers 5 tiers to their product.

Trial: Send documents for signature with basic fields, audit trail, and integration with Dropbox, Box, etc.

Single-user: Same functionality as Trial but with reusable templates.

Multi-user: Same functionality as single-user but with reminders, notifications, personalized branding, and other features.

Business Pro: Same functionality as multi-user but includes payment collection, advanced fields, bulk send, advanced authentication, and other premium features.

Enterprise Pro: Same functionality as Business Pro but also includes partner integrations, SSO, enterprise support, advanced admin tools, and companies can build their own workflows through the DocuSign API.

Strengths

Product Love: Strong efficiency and effectiveness

In fiscal 2020, 82% of all transactions on the DocuSign eSignature platform were completed in less than 24 hours and 50% within 15 minutes. The core product has contributed to faster turnaround times, such as less time spent creating new agreements or less time spent finding completed agreements that include certain legal provisions.

Strong Operating & Financial Metrics

Consumer Growth: As of January 31, 2021, DocuSign had over 890,000 customers, including over 120,000 enterprise and commercial customers, compared to over 585,000 customers and over 70,000 enterprise and commercial customers as of January 31, 2020. Overall revenue growth has been higher than customer growth which shows increased spend on a per-customer basis.

Long-term subscription-driven revenue: Majority of Docusign’s revenue is driven by subscriptions, which accounted for 95% and 94% of our revenue in the three months ended October 31, 2021 and 2020. A couple of key reasons why SaaS business models have really picked up speed in the last 5 years:

Recurring revenue: Creates a predictable source of cash flow for the company on a monthly basis.

Low upfront costs: $10-$40 per month subscription fee helps lower initial adoption barriers.

Unit economics: Unlike traditional software business models, subscription-based pricing helps make unit economics a lot easier to understand due to the predictability of revenue. Management teams can make better forecasts and create more focused long-term plans due to better forecasting.

Up-Selling: Platforms like DocuSign can easily sell more products/services to existing clients.

Dollar-Based Net Retention Rate: Docusign stopped reporting dollar-based net retention numbers after 2018 but in 2017 & 2018 the dollar-based net retention rate was approximately 112% and 115% respectively. As explained in previous blogs, this means that clients not just stick around but actually spend more on the product.

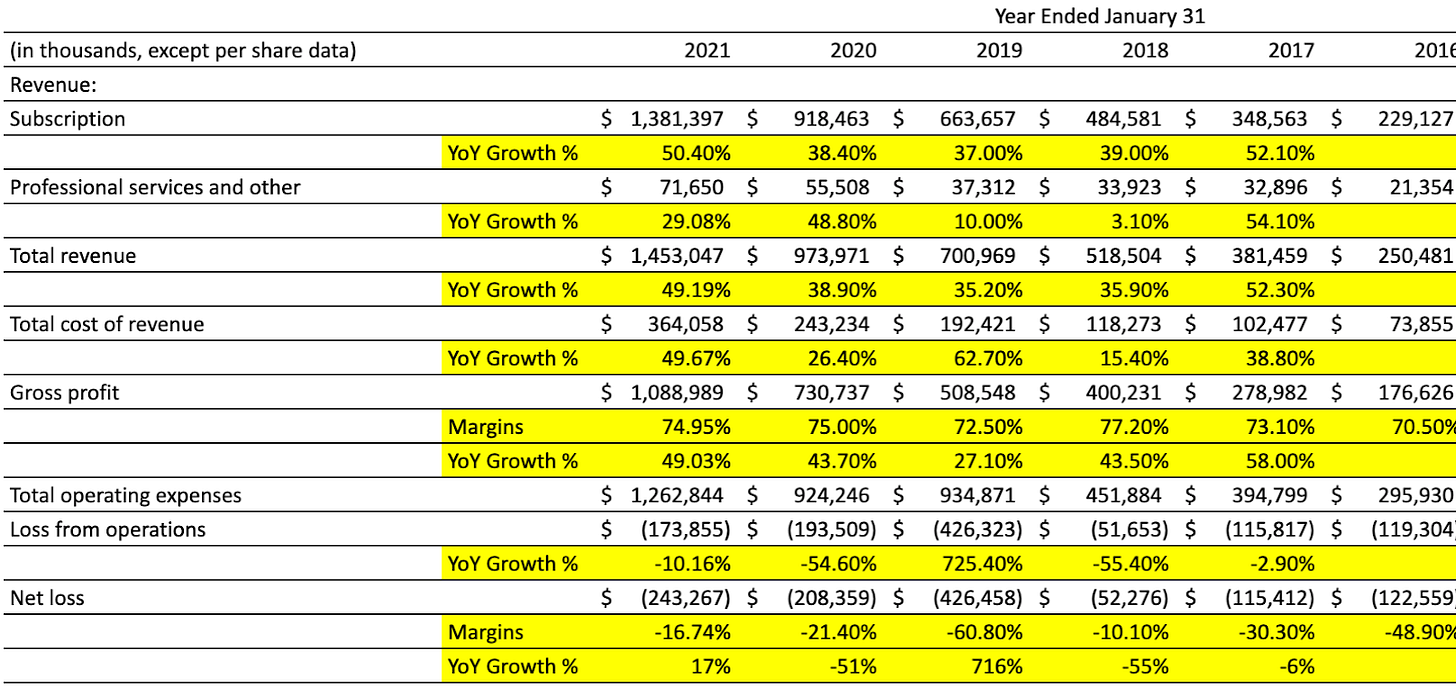

Revenue: Solid growth in overall revenue with a bigger chunk coming from the subscription business rather than professional services. This makes me more optimistic about their overall performance cause this revenue is here to stay.

Loss-making: DocuSign has remained unprofitable since its founding which is definitely a concern considering it was founded in 2003. The overall margins seem to be improving but serious measures need to be taken even in the short term in order to decrease further capital requirements.

Huge Growth Opportunities

Currently, 20% of DocuSign’s revenue comes from international markets. The product has shown massive growth of 77% in revenue numbers as the company was able to capture the COVID-19 tailwinds well. Most of this has been fueled by DocuSign expanding to other English-speaking countries with legal processes similar to the US. I believe the opportunity size is massive as the product caters to a large variety of stakeholders. Along with that DocuSign’s prime user base are real estate agents who are present across the globe. I’m fairly optimistic as many other countries have a lot more friction in the process, and thus, DocuSign can truly create a moat and have greater pricing power.

COVID-19 shift to digital

As I described in my previous blog posts the COVID-19 pandemic has truly accelerated the digital transformation. Remote work(global teams) being one of the biggest trends as companies put the health in safety of their workers in the front seat. I believe this trend has truly helped DocuSign become a core part of the enterprise workflows. After using the product customers have been able to recognize its ease of use, decreased costs, and the social impact the product creates. I believe this push is truly what the company needed in order to expand and build faster. The growing demand for different use cases with massive opportunities will help DocuSign gain more traction and understand markets better due to the craving customers.

Weaknesses:

Competition

There are many other competitors in the space most notably Adobe Sign. I believe that the competition is there but the market is enormous. Thousands of contracts and agreements are signed every day and thus everyone can have a piece of the pie. I believe the biggest competition is top technology companies with the massive distribution. The last couple of years have proved that the biggest giants can use the resources at their disposal in order to build competing products. Thus, I believe that top technology companies like Microsoft, Slack, and others in the B2B SaaS space could cause some serious problems.

Valuation

DocuSign has been a hot stock that has picked up speed in 2019. Since its IPO in 2018, the valuation numbers have gone from $4.4 B to over $37 B. The stock has more than doubled in the last twelve months bringing its forward PE multiple to 150+ which makes the company too richly priced. This is the same phenomenon that DoorDash and other technology-first companies have noticed, an influx of retail investors who really want a piece of the growth. Even though the stock is overpriced, I believe in the company’s story and mission. DocuSign can take this apex moment to accelerate and define its path for the next decade.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.