#17 Peloton: Ride The Health Wave

Peloton is an interactive fitness platform that pioneered connected, technology-enabled fitness and the streaming of immersive, instructor-led boutique classes for its members.

Product

A couple of reasons why Peloton has gained massive popularity and reached scale:

Quality: Peloton is one of the first fitness brands to provide high-quality fitness products and content. Offered at a premium price, the brand promises the best equipment with best in class instruction to match every consumer’s needs. This is showcased by the high NPS score of 94, which proves extreme customer love.

Social & competitive: Historically, fitness has been exercise-driven by group motivation but performed individually. Peloton’s unique vertically integrated hardware and software solution has enabled fitness to become social and competitive.

Ease & vertical integration: Peloton has brought the gym to your home. The fact that consumers can get on a bike or treadmill and directly plug into an integrated fitness community makes it very unique. With individuals becoming increasingly busy most consumers don’t want to commute. The fact that Peloton cuts the commute while providing a better experience is a win all the way.

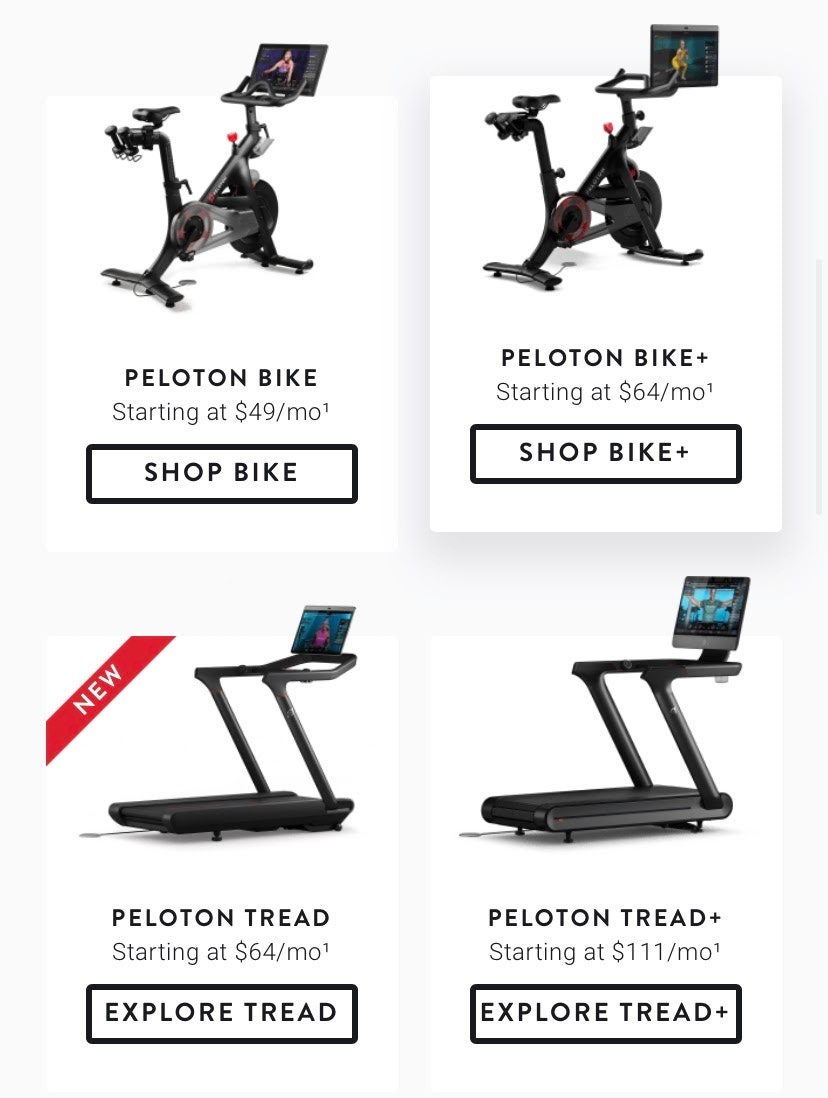

Financing options: Peloton’s easy financing options have really helped its sales. Specifically, the partnership with Affirm lets Peloton buyers purchase whatever they want at 0% interest rate and $0 money down. Partnerships like these have been incredibly useful for Peloton.

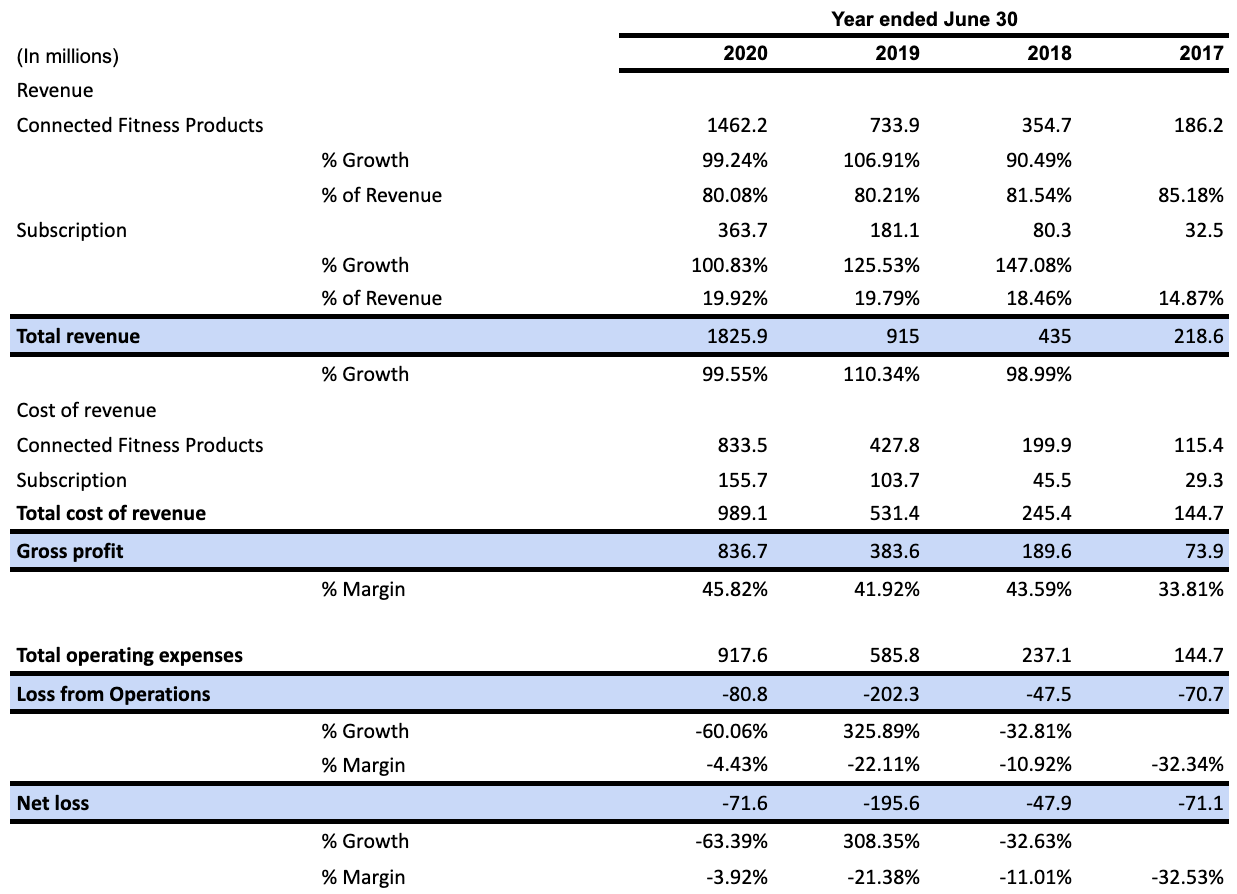

Financial Metrics

Subscriptions: In the last 3 years, subscriptions have shown a 107% CAGR which showcases extraordinary execution from the Peloton team.

Workouts: The 213% CAGR workout growth outpacing the subscription growth really proves that their content strategy is working.

Churn: Peloton has posted incredibly low churn numbers of 0.62%, 0.65% in 2020 & 2019.

Path to profitability: Peloton has posted tremendous revenue growth, which has averaged over 100% in the last three years. Along with that, the net loss has been massively reduced due to its lucrative unit economics driven by low churn and recurring monthly subscription fees.

Community & Content

I believe Peloton’s biggest assets are its community and high-quality content. Pre 2012, hundreds of thousands of people had treadmills or bikes at home that they never used. The highly engaging community, competition, and result-oriented while fun content truly has proved to be Peloton’s biggest asset. Peloton’s high investment in content and community has paid off. Now the company has the flexibility to experiment and can try other strategies like affordable solutions up-selling other fitness products, amongst other services. The integrated ecosystem has moats built inside, which makes it an incredible business.

Tailwinds

The COVID-19 pandemic has provided massive tailwinds for the company. The company expects to keep up its growth numbers due to the following reasons:

Rise of remote work: The post-pandemic world will adopt a hybrid model to work, which means individuals will go to the office less than 5 times a week, thus spending more time at home.

Unsafe public gyms: COVID-19 as a virus will not be eradicated, and thus, public gyms will always have safety concerns and capacity issues. Safety concerns as most gyms are indoors, and capacity constraints will not allow them to let users come in at any time.

Increased focus on a healthier lifestyle: The pandemic has really refocused everyone’s attention on personal health and well-being. This will enable more individuals to buy into the Peloton model.

Growth

Peloton’s management team presented audacious goals in its last investor annual investor presentation. The company aims to achieve 100 million users, which I believe is incredibly audacious considering its current market positioning. The company has huge market potential which the following levers can drive:

Greater affordability: Peloton would increase its market share if it can come out with lower price post solutions. I believe this is plausible as all new products have been cheaper than their predecessors and the company has a content moat that’s its building. Peloton’s margins on content are immense, and creating a cheaper bike or treadmill will be the perfect segway to acquire more long-term users.

Geographic expansion: Currently, most of Peloton’s revenue comes from the United States. But the product can would equally well in other countries amongst a similar subsection of the population.

Valuation

Peloton’s stock had seen incredible growth since its IPO in September 2019. The company has reached a $27 billion valuation, up from $8.1 billion. The market has rewarded the company for its past returns and does encompass its future growth prospects. Considering that the stock is down 43% from its recent high, I believe there is still potential in the stock and I’m bullish that the stock will reach the range marked below.

High cost

The cheapest Peloton bike costs $2000, which seriously limits its total addressable market globally. Along with the bike, the bike has limited functionality without the subscription, which costs $39 every month.

Injuries & Recall

In May 2020, Peloton had to recall both its Tread+ and Tread treadmills due to reports of injuries and death of one child. The recall affects about 125,000 Tread+ machines and roughly 1,050 Tread products in the U.S. However, this is a small setback as the number is a tiny fraction of the total number sold, and the company has taken a proactive approach to the problem.

Backlog

Since its inception, Peloton has faced supply chain problems. As a result, even though the company has garnered massive popularity, the product is not reaching consumers instantaneously. This is a function of their supply chains primarily based out of Asia due to cost considerations.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.