#21 Toast: Cooked To Perfection

Best in class verticalized software for restaurants

Strong operating and financial performance

High market penetration but still loss-making

Solid growth opportunities but richly valued

Overview

Toast is a cloud-based, end-to-end technology platform purpose-built for the entire restaurant community. The platform provides a comprehensive suite of SaaS, products, financial technology solutions, including integrated payment processing, restaurant-grade hardware, and a broad ecosystem of third-party partners.

Key metrics

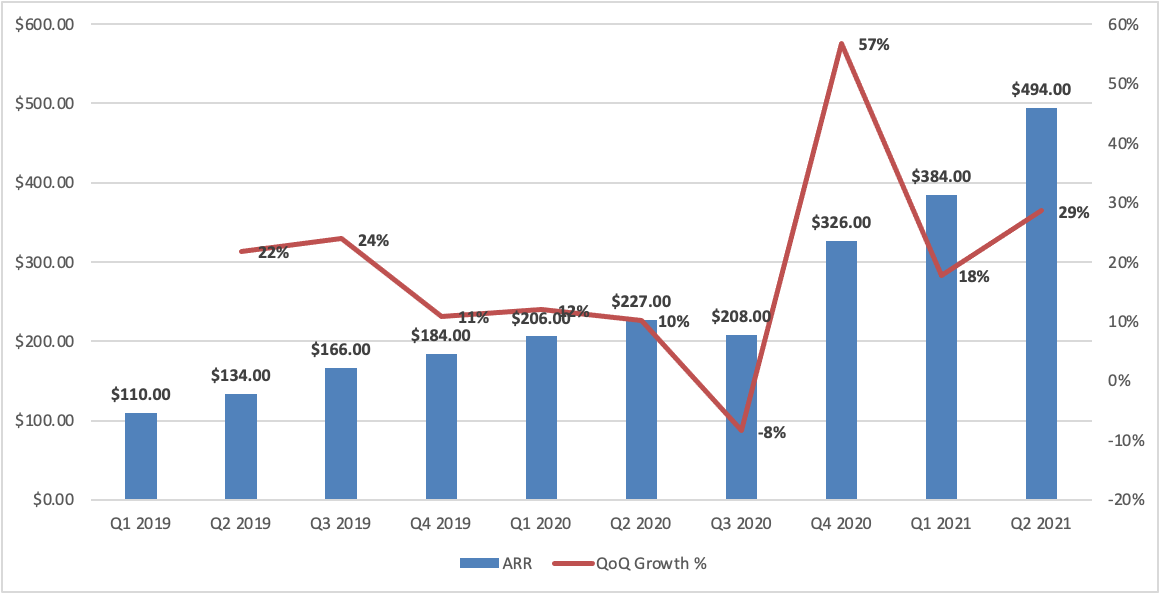

ARR: $494M

ARR Growth YoY: 118%

Locations: 48,000

GPV(TTM): $38B

Annual Net Retention Rate: 110%

U.S. Serviceable Addressable Market: $15B

Revenue Model

Subscription services revenue is generated from fees charged to customers for access to SaaS products, such as POS, kitchen display system, invoice management, digital ordering and delivery, marketing and loyalty, and team management.

Financial technology solutions revenue consists primarily of fees paid by customers to facilitate their payment transactions. The transaction fee is generally calculated as a percentage of the total transaction amount processed, plus a fixed per-transaction fee. Financial technology solutions revenue also includes fees earned from marketing and servicing working capital loans to customers through Toast Capital that are originated by a third-party bank and that range from $5,000 to $100,000.

Hardware revenue is primarily derived from the sale of terminals, tablets, handhelds, and related devices and accessories. Toast also generates professional services revenue from installation and configuration services for new locations joining the Toast platform and new products added by existing locations.

Strong operating metrics

ARR & GPV growth has been fairly strong for a company its size. Toast generated 23% YoY revenue growth in 2020, even through the lockdown. With restaurants opening up across the nation, I believe Toast will see more widespread adoption and better top-line growth.

Net revenue retention for Toast is definitely in the top quartile. The metrics S-1 showcases that retention has been above 100% in the last three years, which is a very good sign. This means that Toast has been able to retain and upsell to all of its customers.

Market penetration: Toast has been focusing primarily on the US market, in which they have showcased flawless execution. The company currently operates in just above 6% of all restaurants in the US. I believe with the scale, this growth will only accelerate as Toast has strong organic growth. As of June 300, 2021, approximately two-thirds of new locations added to the Toast platform in the last twelve months came inbound through organic, paid, field, and referral channels.

Payback period for Toast is approximately 15 months which is higher than SaaS companies but justified considering it sells point-of-sale solutions.

Verticalized software

Toast is one of the prime examples of vertically integrated software that entered the ecosystem with its point of sale solution but then upsold to all of its customers. After getting their foot inside the door, Toast offers human resources, operations, data analytics, and other solutions showcased below.

Strong growth opportunities

Fuel efficient location growth with both new and existing customers

Expand internationally

Increase adoption of the full suite of products

Invest in and expand product platform

Financial statement analysis

Strong revenue growth: Growth is primarily driven by revenue from financial technology solutions and subscription services. Revenue from subscription services increased 62% to $101.4 million for 2020, as compared to $62.4 million for 2019. The increase was attributable to growth in restaurant locations on the Toast platform and the continued upsell of products to existing customers, partially offset by COVID-related SaaS credits and refunded fees.

Diverse revenue streams: Having a diversified revenue stream is a core strength of Toast’s platform. Having the potential to expand across different parts of the business helps Toast retain and upsell to current customers.

Low gross margins: Toast’s margins are well below your average SaaS platform: 17.6% but this makes sense as they make most of their revenue from payments.

Massive losses: Toast is still losing a ton of money. Just in 2020, their net income margins were -30% which represents a loss of $250M. This is definitely alarming but is justified by its current costs. Currently, R&D expenses are 13% of overall revenue and S&M represents approximately 17% of total revenue. If required Toast can produce profitability by reducing these expenses, which would definitely decrease growth but be closer to breakeven or even produce profitability.

GPV Growth

General & Administrative Expenses

ARR

Valuation

Toast went public on 21st September at a valuation of $20B. The company raised $870M in the IPO listing and the stock popped over 30% just on day one. The company is currently trading at $53.5, which equates to $26.9B in market capitalization. This means the company is trading at the following multiples:

P/S: 23.9x

P/C: 70.1x

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.