#11 Wish: Definitely Not On My Wishlist

Summary

Differentiated value proposition & strong operational metrics.

Huge losses with no clear path towards profitability.

Hard to navigate product and massive competition.

Regulator risks: High reliance on China.

Overview

Founded in 2010, Wish is a mobile-first global platform that helps connect merchants with online shoppers. Currently, Wish has over 100 million monthly active users, approximately 500 million registered users, and over 500,000 merchants.

Wish went public in December of 2020 and raised $1.1 billion, putting the company at an initial valuation of more than $17 billion. Since then, the stock has performed very poorly as the current market capitalization is just $9.67 B today.

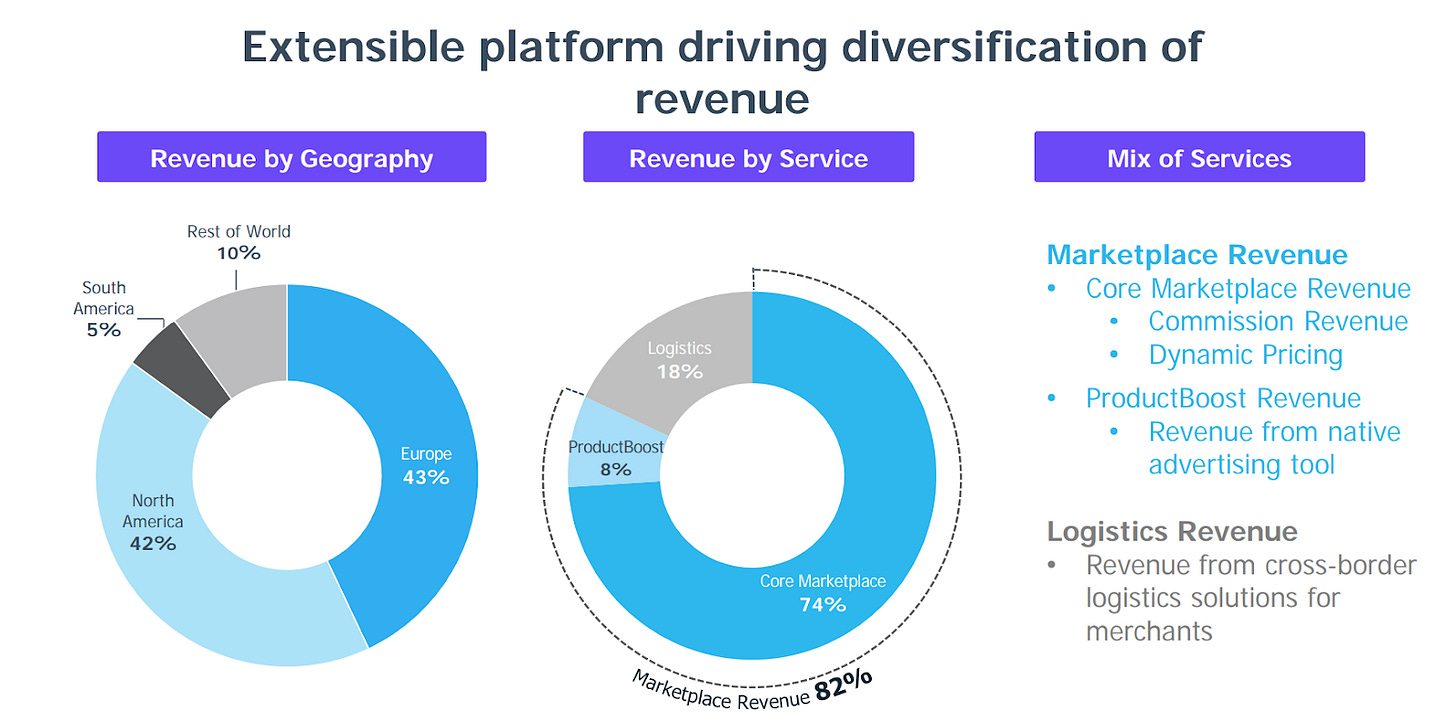

Business Model:

Marketplace Revenue: Wish earns a commission on every transaction that takes place on their platform and provides a service called ProductBoost to help merchants promote their products within our marketplace.

Logistics revenue: Designed for direct end-to-end single order shipment from a merchant’s location to the user. Logistics services include transportation and delivery of the merchant’s products to the user.

Flywheel:

Since its inception, Wish has created network effects that have helped both customers and merchants. More merchants lead to a wider variety of products and hence more consumers.

Strengths

Differentiated Value Proposition

Wish as a platform has been able to capture the market of non-branded cheap items. Products on Wish range anywhere from $2 sunglasses to $15 dress shoes. Peter Szulczewsski, Wish’s founder, understood the lack of liquidity/cash that a majority of customers faced and thus, went on to build a product the anti-Amazon, some may say. This, combined with being one of the first mobile-first e-commerce companies, has truly helped Wish garner massive traction.

Operational Metrics

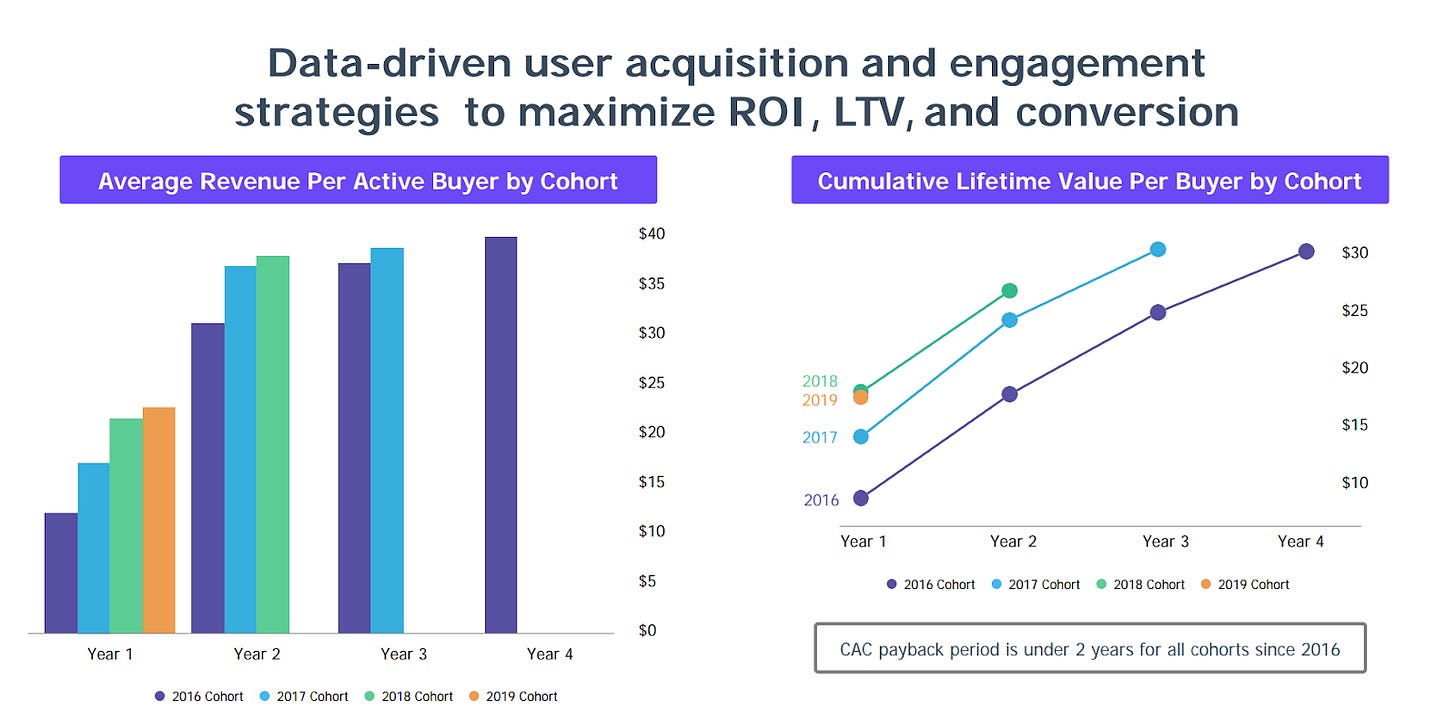

In the last 5 years, Wish has garnered massive traction and was the most downloaded e-commerce platform in 2018. The total MAUs crossed 100 million in 2020, and overall buyer numbers are over 60 M per annum as well, but the small APRU per customer leads to small margins. It takes 2 years for CAC payback which seems awfully high considering the characteristics of the business:

Focus on product discovery: Selling wants not needs

Small ticket size: Average cost of items is fairly small

Weaknesses

Product: Hard to navigate and clunky

Wish’s website is probably one of the hardest to navigate in comparison to its competitors. Wish as the platform is discovery-driven as individuals come on the platform and buy cheap items that they might not necessarily need. This makes the platform not optimal for higher ticket and more focused buyers. I believe that this is a weakness because the marketplace has been able to create topline growth through its current strategy, but the only way to increase profitability might only be through higher ticket items.

Low-quality products, fraud, and long delivery times

One of the biggest problems for Wish has been the low quality of products offered by its merchants. This, combined with widespread fraud on the platform, has sparked many negative reviews and diluted the brand name. Wish has taken some drastic measures in order to curb fraud, like reviewing its merchants and kicking off about 400,000 of them. This removal was a way for Wish to curb future fraud and the sale of counterfeit items on the platform. Along with that, most products take an eternity to ship to the actual users: Average shipping takes 2-4 weeks because most products are being shipped from China, Myanmar, and other emerging markets.

Massive competition

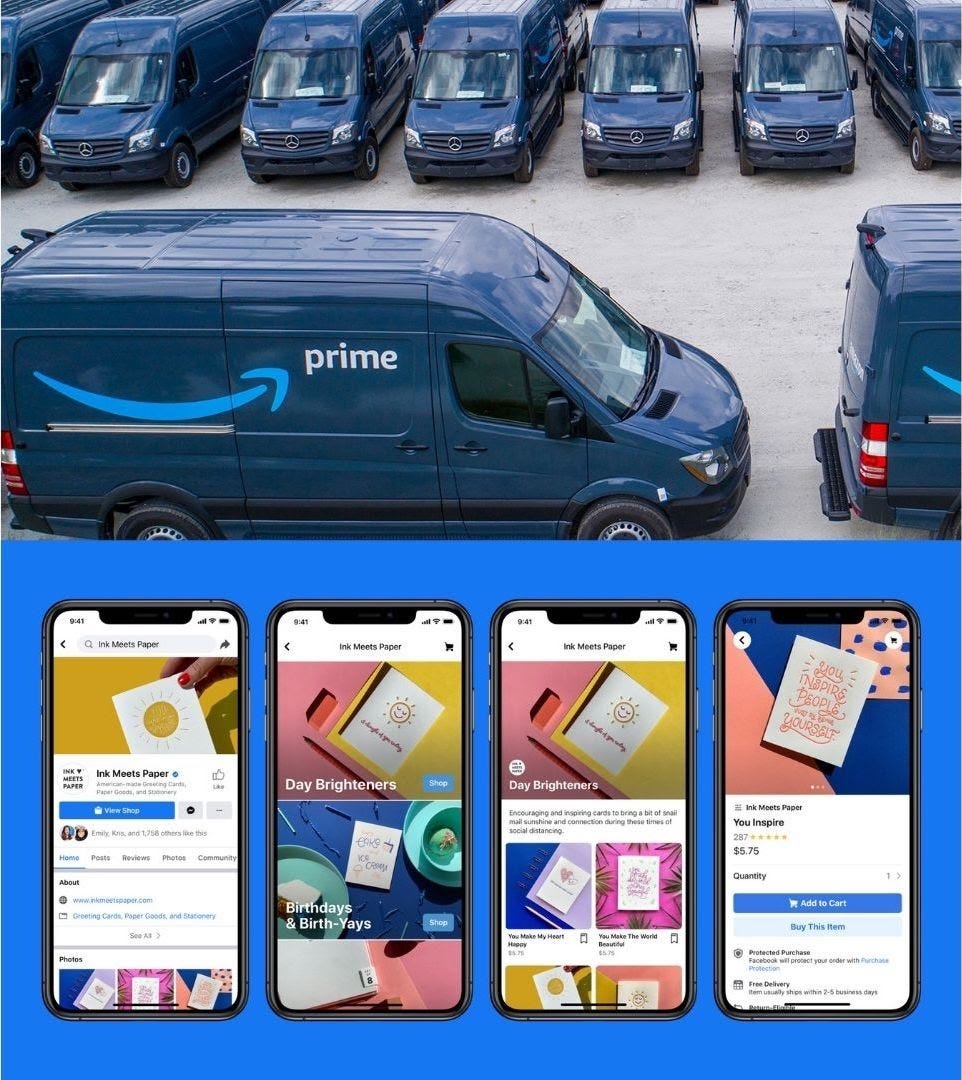

Wish is in the crowded e-commerce market with other humongous players like Amazon, eBay, and many others. Amazon is the biggest competitor due to its massive and very well-functioning supply chain processes. There are currently 150 million Amazon Prime subscribers, a 50 percent increase from 100 million in April 2018. Amazon currently has over 9.7 million sellers worldwide and has been trying to move more and more into Wish’s market. Along with that, other big players like Facebook, which has massive distribution, are trying to enter the e-commerce space. Keeping these factors in mind, I believe Wish needs to move fast in order to maintain its position amongst these giants.

Huge losses with no clear path towards profitability

Summary:

Revenue: Wish has been able to attract massive traction, and that shows in its growing topline revenue numbers.

Losses: Wish has been loss-making since its inception and showed no signs towards profitability, but the pandemic has completely put them off track. The losses seem to be pilling up with decreasing gross and operating margins.

COVID-19 Headwinds: The COVID-19 pandemic has adversely affected many businesses that were selling wants rather than needs. I believe that even though Wish is geared towards product discovery, its affordability should have increased its overall traction in the pandemic as individuals have decreased buying power.

Increased operating expenses: The income statement shows increased operating expenses, including 2020, which have not translated to significant margin improvements over the last 12-24 months.

High reliance on China

According to their 10K, most of the merchants on Wish are based out of China. This was a huge benefit as it helped Wish as a platform curate a wide variety of products around key benchmarking prices. But the recent rise in tensions between the governments presents massive risks for the company. The government hasn't shown any relaxation of tensions since its transition.

Links:

The hot e-commerce app Wish has “hundreds of millions of users” (plus other fascinating stats)

Wish Revenue & Usage Statistics(2021)

Wish, the super popular, ultra-cheap shopping app, explained

How Wish built a retail empire for shoppers to buy on the cheap under the nose of Amazon

Meet The Billionaire Who Defied Amazon And Built Wish, The World’s Most-Downloaded E-Commerce App

Three Reasons Why Wish Parent’s Widely Anticipated IPO Was A Dud

Shopping app Wish building an empire on $2 sunglasses to rival Amazon, Walmart

Wish Files For IPO Citing Losses, Revenue Growth Due To COVID-19

How Wish passed $1 billion in revenue by inverting Amazon’s strategy

Online retailer Wish falls in 2020’s worst debut for big U.S. IPO

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.